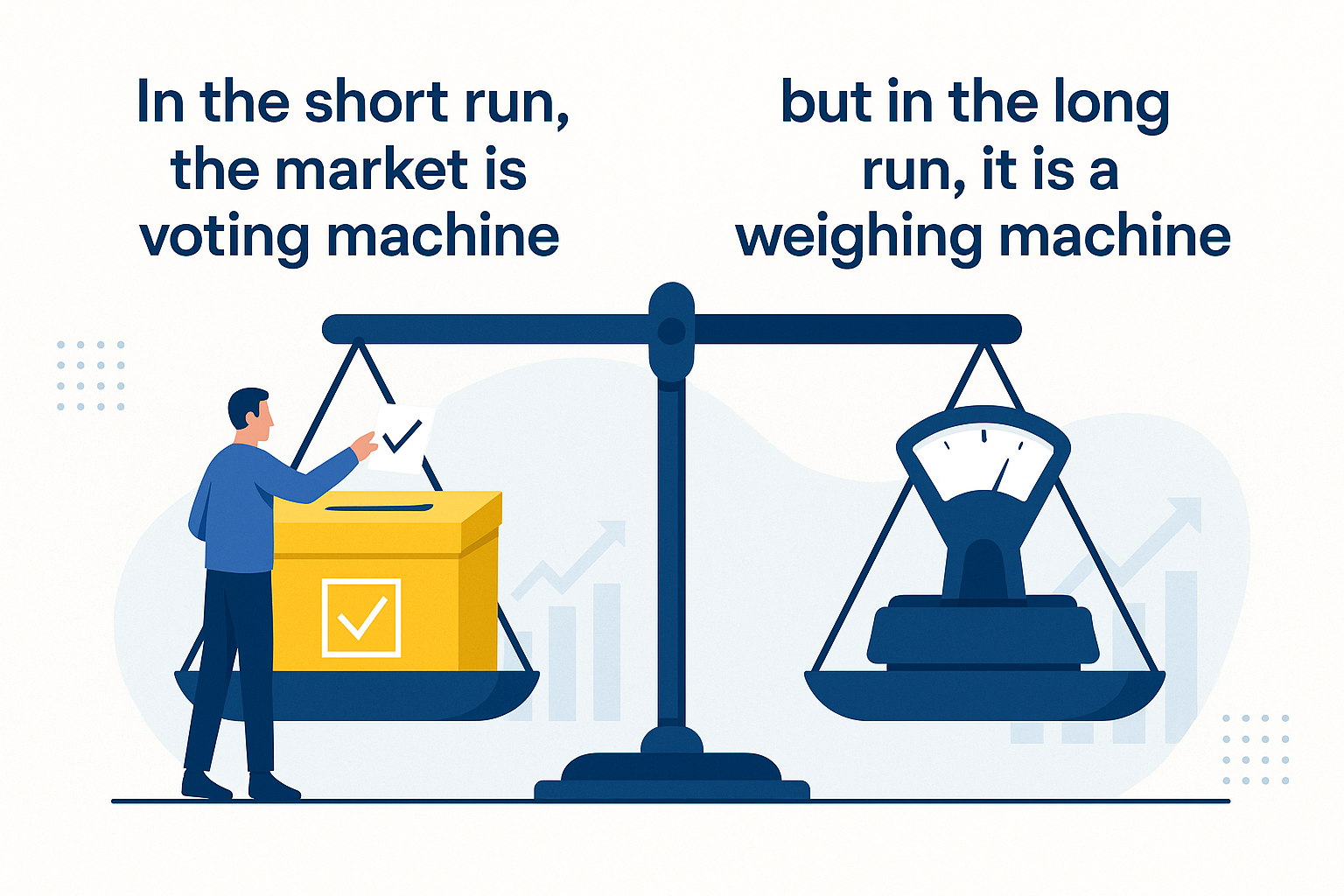

“In the short run, the market is a voting machine, but in the long run, it is a weighing machine.”

— Benjamin Graham, popularized by Warren Buffett

Understanding the Quote

This timeless insight explains how the market works — and why investors often misread it.

In the short term, the stock market behaves like a voting machine, where prices reflect popularity and sentiment rather than real value. Every investor “votes” with money, and collective mood swings — greed or fear — decide what’s hot and what’s not.

But over the long term, the market transforms into a weighing machine, assessing the real worth of companies based on their performance, earnings, and durability. The noise fades; substance remains.

Short-Term Votes: When Sentiment Drives Prices

In the “voting” phase, narratives overpower numbers.

-Stocks rally on hype — “green energy,” “AI,” “EV,” “defence.”

-Or crash due to panic, policy fear, or quarterly disappointments.

It’s not that fundamentals vanish — they just get drowned out by the crowd’s emotions.

Think back to 2020–21: new-age Indian tech IPOs like Zomato, Paytm, and Nykaa were the darlings of retail investors. Their listings were driven by optimism, brand recall, and FOMO. The “voting machine” loved them — prices soared beyond intrinsic value within weeks.

But when the euphoria cooled and earnings couldn’t justify valuations, the “weighing machine” took over. Over time, prices corrected sharply, reflecting the gap between promise and profit.

Long-Term Weighing: When Reality Sets the Score

Now look at companies like HDFC Bank, Asian Paints, or Titan — businesses that rarely make headlines for drama but quietly deliver growth, year after year.

These are classic “weighing machine” winners.

Their success wasn’t overnight; it was built on decades of consistent earnings, customer trust, and efficient capital use. The market “voted” for them late, but it “weighed” them rightly in the end — handsomely rewarding patient investors.

Investor Takeaways

-Don’t follow the crowd; follow conviction.

Crowd votes are loud, but often wrong. Look for enduring businesses, not trending tickers.

-Patience is your biggest edge.

Let the weighing machine do its job — compounding needs time, not excitement.

-Volatility ≠ Risk.

Price fluctuations are the market’s votes. Ignore them; focus on what the company earns.

-Use corrections as opportunities.

When the voting machine overreacts, it often gives long-term investors a discount.

Why This Matters Now

In an age where daily price updates, influencer videos, and social media polls dominate investor attention, it’s easy to mistake noise for insight. But the lesson remains: sentiment is temporary, value is permanent.

Closing Thought

The stock market will always be part democracy, part balance sheet.

In the short term, it rewards popularity.

In the long term, it rewards performance.

At Univesto Capital, we believe that true wealth is built by trusting the weighing machine — not the crowd’s votes. The businesses you hold should be those that can withstand time, not just trends.