In the 1990s, a US airline faced a crisis: passengers complained endlessly about slow baggage delivery. Consultants proposed millions in new tech and faster belts. But one employee noticed something subtle. The baggage was reaching in 8 minutes. Passengers reached the belt in 1 minute. ...

Did you know that Kodak once consumed nearly 50 million ounces of silver every year—roughly 20% of global supply—to coat photographic film with silver halides? At its peak in the late 1990s, this single company stood as a pillar of industrial silver demand. The linkage was tight, predictable,...

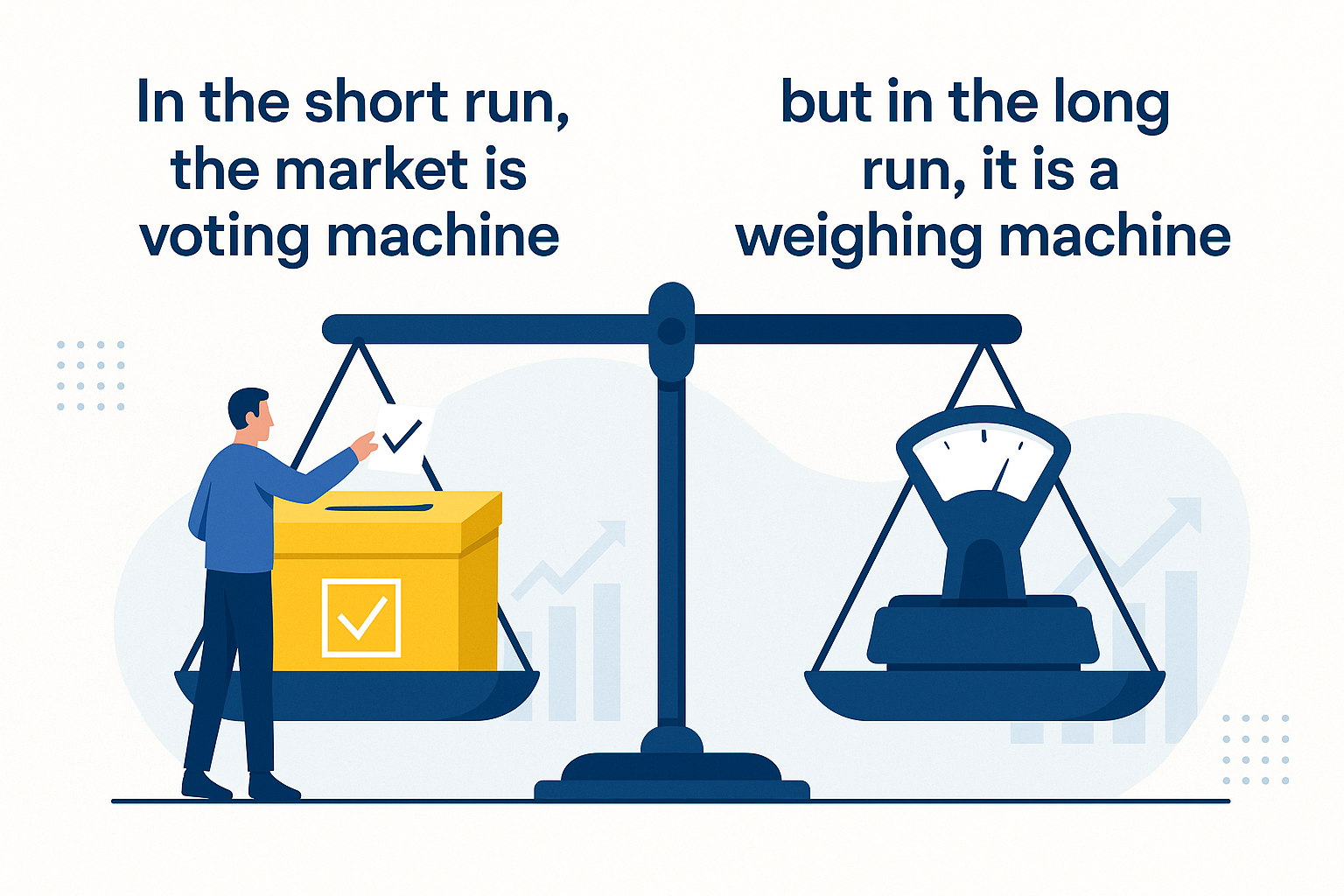

“In the short run, the market is a voting machine, but in the long run, it is a weighing machine.” — Benjamin Graham, popularized by Warren Buffett Understanding the Quote This timeless insight explains how the market works — and why investors often misread it. In the short...

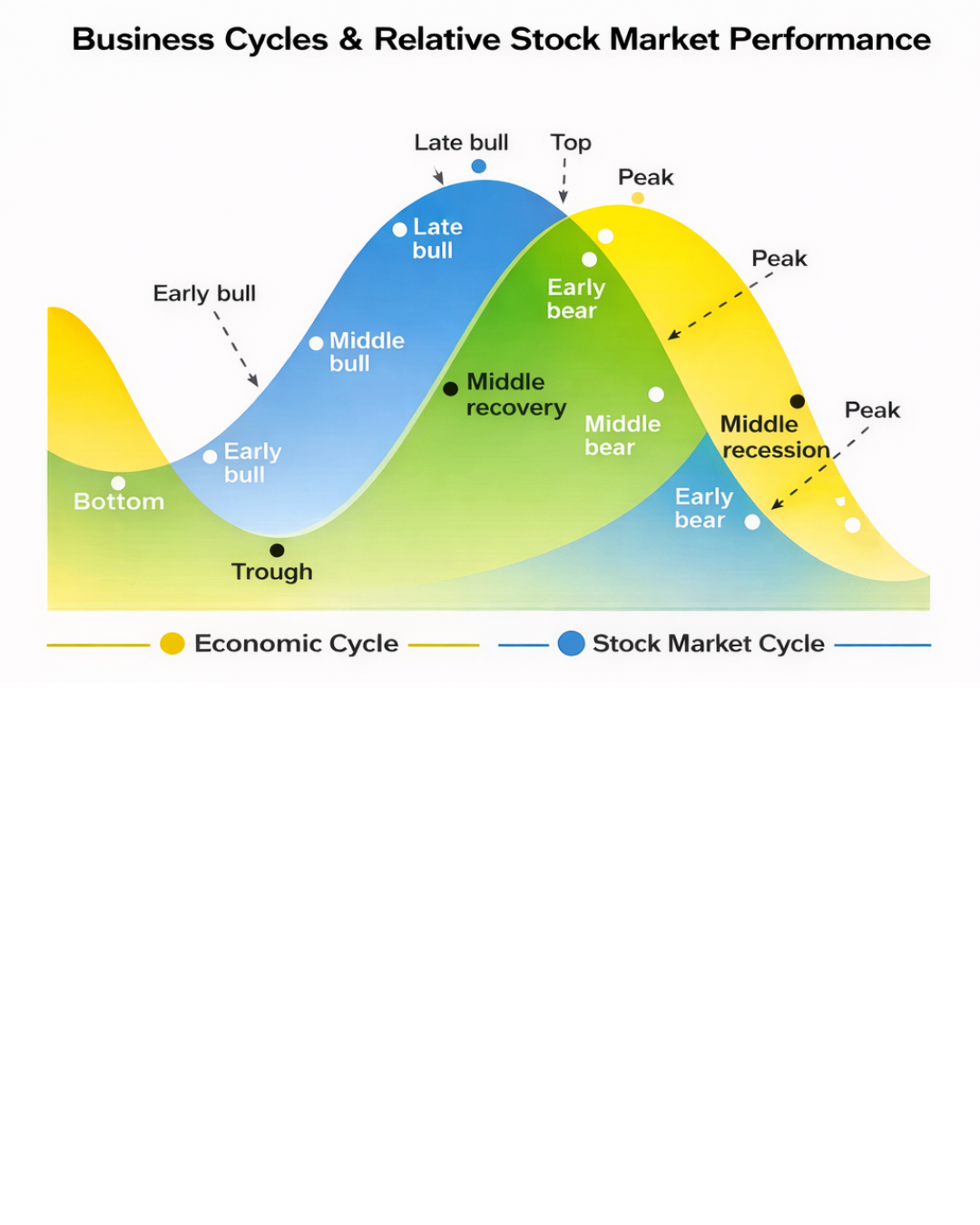

When investors look at the Nifty, they usually focus on price levels. But markets don’t move randomly. Beneath every index movement lie four powerful cycles working simultaneously: – Economic Cycle – Business (Profit) Cycle – Credit Cycle – Sentiment (Behavioural) Cycle “Markets are driven by cycles of fear and...

One quiet morning by the sea, a businessman met a fisherman resting beside his modest boat. The businessman urged him to catch more fish, earn more money, buy more boats, build an empire—and then, at the end of it all, retire by the sea to enjoy life with his family....

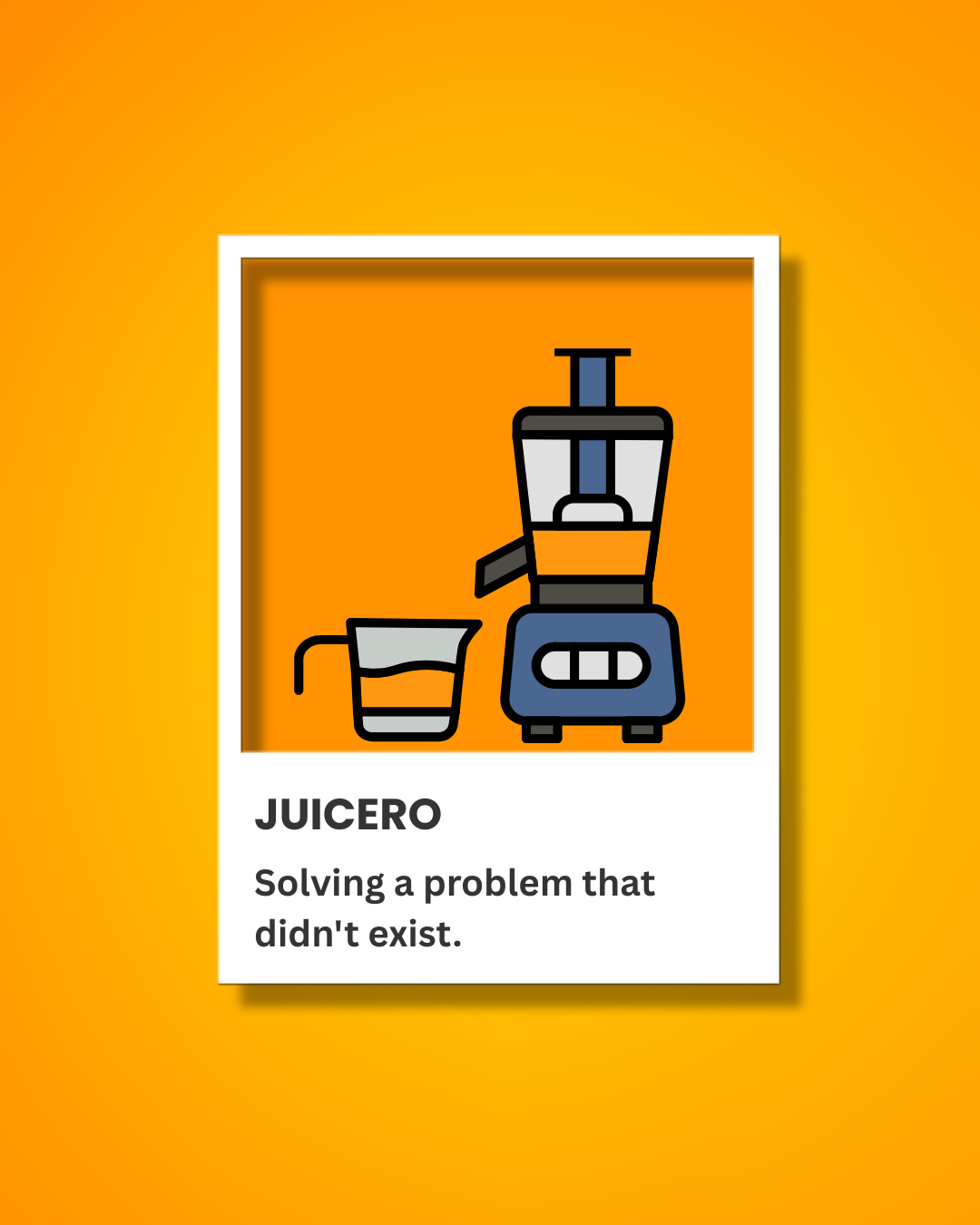

In the world of startups, we often celebrate bold ideas, futuristic products, and the courage to dream big. But sometimes, in the race to innovate, companies forget the most important question: Is this solving a real problem? One of the best examples of this is Juicero, a Silicon Valley...

In his Independence Day address, the Prime Minister announced a sweeping change to the Goods and Services Tax (GST) structure. The government now proposes to merge the four existing GST slabs into two main rates—5% and 18%, while keeping a higher band for sin and luxury items. If all goes...

Imagine having access to tomorrow’s news today. Wouldn’t that be the ultimate investing edge? That’s exactly what an experiment by Elm Wealth tried to test. They gave 118 finance students access to the next day’s Wall Street Journal front page—a full 24 hours before it went public. You’d expect...

In investing, just like in global affairs, the distinction between being risk averse and risk prepared can make all the difference. While both approaches aim to protect value, their outcomes diverge dramatically over time. Today’s geopolitical climate offers a powerful analogy. As conflicts simmer across regions — from...

One night, a ghost quietly cut the rope of a donkey tied to a tree, setting it free. The donkey, unaware of the consequences, wandered into a nearby farmer’s field and trampled the crops that had taken months of hard work to grow. Furious at the loss of his...