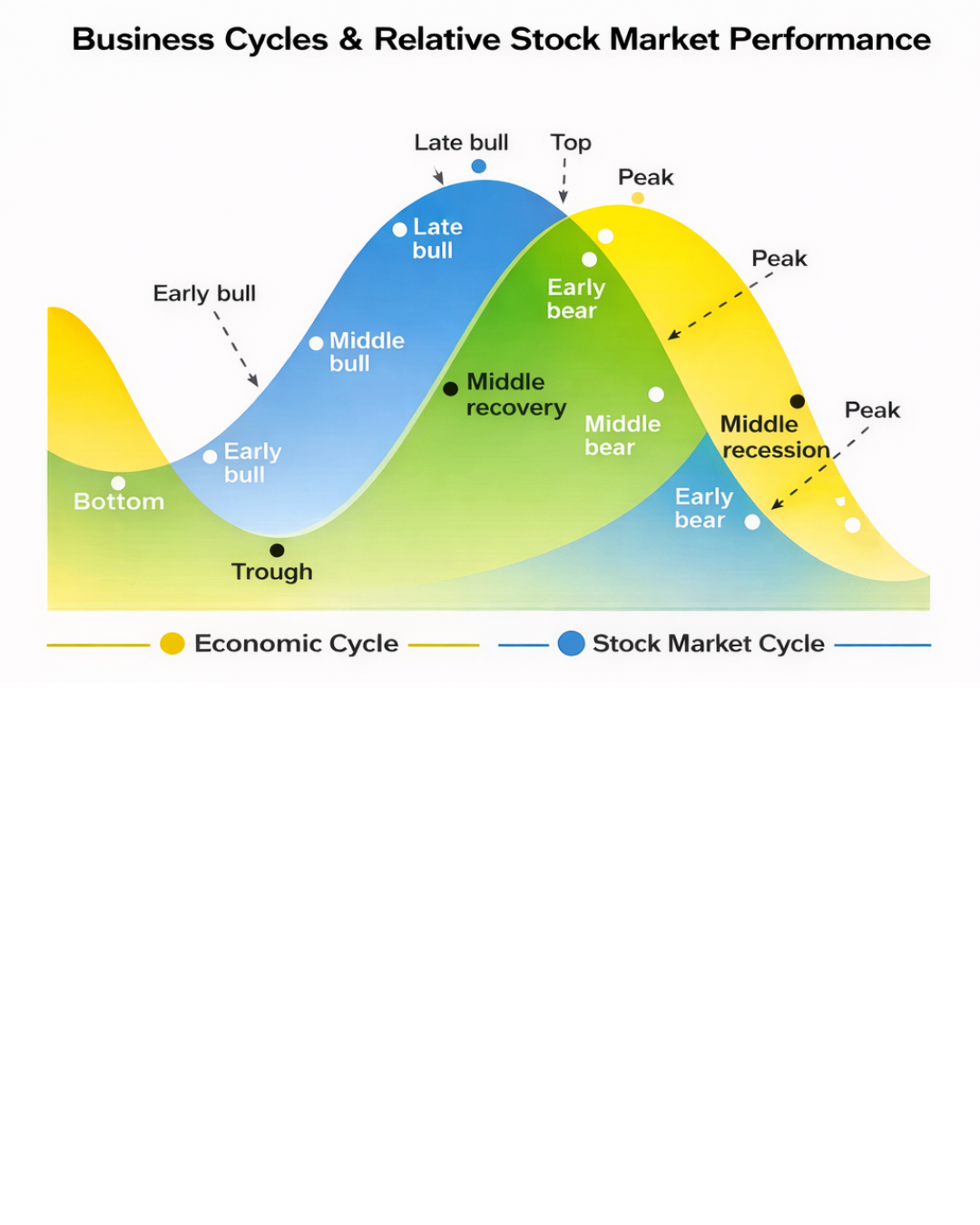

When investors look at the Nifty, they usually focus on price levels. But markets don’t move randomly. Beneath every index movement lie four powerful cycles working simultaneously:

– Economic Cycle

– Business (Profit) Cycle

– Credit Cycle

– Sentiment (Behavioural) Cycle

“Markets are driven by cycles of fear and greed, but wealth is created by understanding where you are in the cycle.”

Understanding these layers helps investors stay rational when narratives turn noisy.

Economic Cycle: From Pause to Momentum

The economic cycle typically moves through boom, slowdown, and recession phases. The second half of 2024 saw a slowdown in economic activity, especially post-elections, as investment spending and project execution were delayed. Growth momentum softened, not because of lack of intent, but because spending was not translating into completion.

“Economic slowdowns are often pauses, not full stops.”

From 2025 onwards, coordinated action from both fiscal and monetary authorities aimed at reviving aggregate demand led to a gradual recovery:

-Income tax cuts increased disposable income

-GST rationalisation boosted consumption

-This rise in consumption triggered a virtuous cycle—higher demand, better utilisation, improved growth visibility.

“Consumption is not just an outcome of growth; it is often the trigger.”

Status: Economic cycle has clearly turned positive.

Business Cycle (Profit Cycle): Where Markets Truly Respond

The profit cycle has a far stronger influence on Nifty than the broader economic cycle. This is because earnings magnify growth through operating and financial leverage.

“Stock markets don’t discount GDP—they discount future profits.”

Key developments:

-From 2024 till now, earnings momentum has improved steadily.

-FY25 ended with ~6–7% earnings growth.

-FY26 is expected to deliver high single-digit to low double-digit growth.

-FY27 earnings growth expectations stand at ~14%, signaling a clear acceleration.

“When profits accelerate, markets don’t wait for perfect clarity.”

Status: Profit cycle is strengthening.

Credit Cycle: The Invisible Fuel

The credit cycle is defined by interest rates and liquidity.

Since early 2025, the RBI has:

-Cut interest rates

-Conducted OMOs to infuse liquidity

-Easier credit improves borrowing capacity, boosts capex, and supports both consumption and corporate profitability.

“Liquidity doesn’t create fundamentals, but it amplifies them.”

Status: Credit cycle is clearly supportive.

Sentiment Cycle: The Missing Piece (For Now)

Sentiment often lags reality.

From early 2025, investors remained cautious due to:

-Geopolitical tensions

-Tariff uncertainty

-Wars and global instability

-While conditions have marginally improved, risk appetite is still restrained.

“Markets climb the wall of worry far more often than they fall off optimism.”

Status: Sentiment cycle is yet to fully turn.

When Cycles Diverge, Opportunity Emerges

History shows that the most attractive phases for long-term investors appear when:

✅ Economic cycle is improving

✅ Profit cycle is accelerating

✅ Credit cycle is supportive

❌ Sentiment remains cautious

“The best returns are earned before confidence becomes consensus.”

This is the phase where disciplined investors accumulate equities, rather than wait for comfort.

Final Thought

Markets rarely reward those who wait for perfect clarity. Today, three of the four critical cycles are aligned positively, while sentiment is still hesitant. This divergence is not a risk—it is an opportunity for long-term investors.

“By the time sentiment feels safe, valuations stop being attractive.”

In market cycles, patience is not about waiting—it is about investing when conviction is uncomfortable and fundamentals are strong.